In forex, how many pips does it take to double your cash?

In forex, what number of pips does it take to double your cash?

demo accounts that allow you to practice trading without investing a single dollar. The measurement of a demo account with FBS could be up to $1 million. The demo account will permit you to practice opening orders and setting place sizes. Forex scalping is a method of trading the place the dealer typically makes a number of trades each day, attempting to revenue off small worth actions.

Gold Trading Signals – A Beginner’s Guide, Part 2

What is a lot size in Forex?

In the past, spot forex was only traded in specific amounts called lots, or basically the number of currency units you will buy or sell. The standard size for a lot is 100,000 units of currency, and now, there are also mini, micro, and nano lot sizes that are 10,000, 1,000, and 100 units. Lot. Number of Units. Standard.

Setting as much as be a scalper requires that you have superb, reliable entry to the market makers with a platform that enables for very fast shopping for or selling. Usually, the platform could have a buy button and a promote button for every of the foreign money pairs so that each one the trader has to do is hit the appropriate button to either enter or exit a place. In liquid markets, the execution can take place in a fraction of a second.

Therefore, Tyrcord, Inc. assumes no accountability for the risks incurred by anyone appearing solely on the basis of this info and results. Trading in financial devices and/or cryptocurrencies entails high dangers including the risk of losing some, or all, of your investment quantity, and will not be appropriate for all investors.

This translated into USD at an change fee of 1.6800 equals $168USD. This is $168USD I am risking for this trade I am about to hypothetically place. Gold is traded in ounces, with one hundred forex broker ounces traded per commonplace lot (one hundred,000 items).

How many pips is a lot?

A micro-lot is 1,000 units of the base currency in a forex trade. The base currency is the first currency in a pair or the currency that the investors buys or sells. Forex traders can also trade in mini lots and standard lots.

Please can anyone give me the method for calculating it as I can’t seem to work it out. Novice or introductory traders can use micro-tons, a contract for 1,000 models of a base foreign money, to reduce and/or fine-tune their place measurement.

Prepare Your Trading Charts

For example, a one hundred-pip move on a small commerce is not going to be felt almost as a lot as the same a hundred-pip move on a very giant trade dimension. Pips are one of many methods by which merchants calculate how a lot position size calculator profit they made or misplaced on a trade. For instance, should you enter a long position on GBP/USD at 1.6550 and it strikes to 1.6600 by the point you close your place you have made a 50 pip profit.

![]()

Cory Mitchell wrote about day buying and selling professional for The Balance, and has over a decade expertise as a brief-time period technical trader and financial author. You haven’t provided adequate context for your question, as this will apply to Lot Size or to a value change on a chart. , I commenced educating myself about Forex Trading in 2012 and continue to learn. What this quote means is that for US$1, you should buy about zero.7747 euros. If there was a one-pip improve in this quote (to 0.7748), the value of the U.S. greenback would rise relative to the euro, as US$1 would let you buy barely more euros.

Try buying and selling threat free

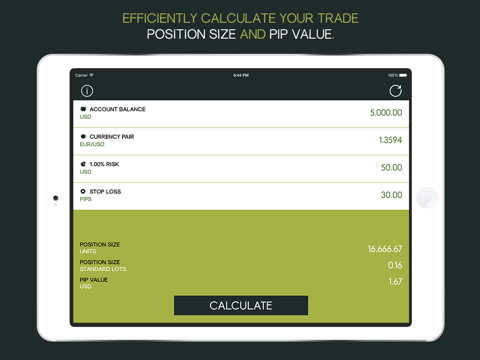

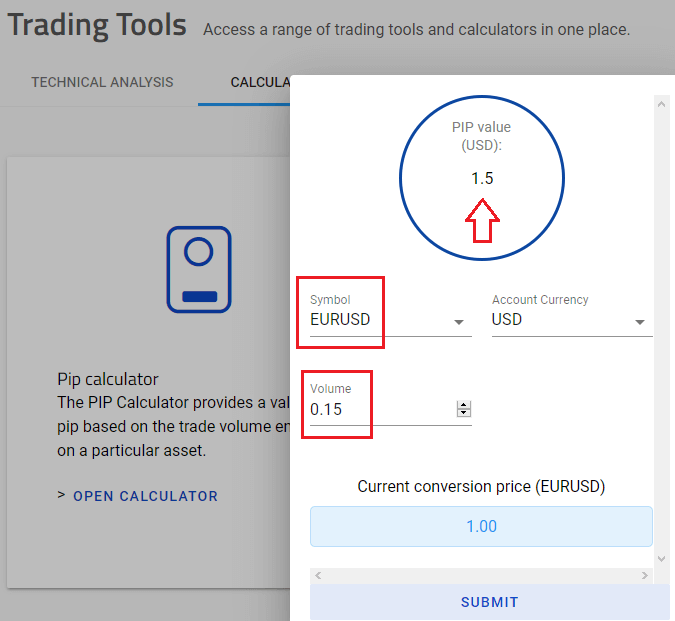

In order to manage danger with more accuracy, it is necessary so that you can know the pip worth of each commerce within the foreign money of your buying and selling account. All you want is your base foreign money, the forex pair you’re buying and selling on, the trade forex broker fee and your position dimension to be able to calculate the value of a pip. To manage danger more effectively, it is very important know the pip worth of every place in the currency of your trading account.

Here are examples of pip values for EUR/USD and USD/JPY, relying on lot size. In the previous, spot forex was only traded in particular quantities margin calculator referred to as heaps, orbasically the variety of currency items you’ll purchase or promote.

It’s all the time safer to at least set your stop loss earlier than opening the commerce. This is simply in case a sharp market transfer abruptly strikes against https://www.umarkets.com/ your commerce before you possibly can place your cease loss order. The most simple method is to buy bodily gold, of course.

- The spreads sometimes are $zero.40-$1.00, relying on the broker.

- If you trade 0.01 heaps, you’ll be able to have a Stop Loss of as much as 30 pips — this is more than enough for an intraday position.

- Scalpers have to ensure that their trades shall be executed at the levels they intend.

- Pips are one of the methods by which traders calculate how much revenue they made or lost on a commerce.

- Buying and selling bodily gold is rather more expensive than buying and selling gold CFDs on-line.

- If there was a one-pip enhance in this quote (to zero.7748), the worth of the U.S. greenback would rise relative to the euro, as US$1 would allow you to purchase slightly more euros.

How can I get 100 pips a day?

A mini lot is a currency trading lot size that is one-tenth the size of a standard lot of 100,000 units—or 10,000 units. One pip of a currency pair based in U.S. dollars is equal to $1.00 when trading a mini lot, compared to $10.00 when trading a standard lot.

John Russell is a former writer for The Balance and an experienced web developer with over 20 years of experience. He lined subjects surrounding domestic and international markets, foreign currency trading, and SEO practices. You will discover that every one pairs with USD as the quote currency have a pip worth of roughly $0.00001 USD. You might have noticed that in all the examples above, the pip is both within the fourth or second decimal place. For instance, on EUR/USD the pip is the fourth decimal, on GBP/JPY the pip is the second decimal.

How do you trade Xauusd forex?

The pip value is calculated by multiplying one pip (0.0001) by the specific lot/contract size. For standard lots this entails 100,000 units of the base currency and for mini lots, this is 10,000 units. For example, looking at EUR/USD, a one pip movement in a standard contract is equal to $10 (0.0001 x 100 000).

Pip Value Calculator

You’ve probably heard of the phrases “pips,” “pipettes,” and “heaps” thrown round, and right here we’re going to elucidate what they are and show you how their values are calculated. Exinity Limited is a member of Financial Commission, a global group engaged in a decision of disputes throughout the monetary services trade in the Forex market. Exinity Limited () is regulated by the Financial Services Commission of the Republic of Mauritius with an Investment Dealer License bearing license number C . ForexTime UK Limited (/uk) is authorised and controlled by the Financial Conduct Authority with license quantity .

So a 50 pip change is is just $50 the thing with gold is this adjustments so quick because the commodities value doesn’t change on the same fractional fee as currency pairs. Scalpers wish to try and scalp between five and 10 pips from every trade they make and to repeat this process time and again throughout the day.

I idiotically began using it with real money right away, and with newbies luck pulled over 200 pips on my first commerce!! Thinking this was a “fail-protected” system, I continued to trade it and over the following few days I shortly gave up all my profits and then some together with some extra cash to horrible slippage. I determined at that time metals buying and selling was out of my league and I would just stick with foreign exchange. To reply your question in case you are trade 10oz it will be zero.10c a pip, when you were trading 100oz it’s going to $1 per pip and $10 for 1000oz. So at 50 pips your greenback amount might be 50 pips x $1 for 100oz of gold.

What is the best lot size in Forex?

If you are a beginner and serious about live trading, then it is highly recommended to trade forex only in micro lots. The recommended account value for trading in forex micro lot size is in between $200 to $500, depending on how many pairs you would trade. You may also make use of the leverage to trade more.

The Ins and Outs of Forex Scalping

Although it’s commonly believed that gold trading is usually inversely correlated to stock markets, this is a dangerous assumption to construct buying and selling strategies on. Yes, buying and selling gold would in all probability be a unbelievable safe haven within the event of a significant flight to security. If you make a mental observe of multiplying your traditional forex cease loss by 10, you received’t make the error of setting a stop loss on gold which is tighter than you actually intended it to be.

The Following 2 Users Say Thank You to pipsurfer For This Useful Post:

Traders typically use the time period “pips” to check with the spread between the bid and ask prices of the foreign money pair and to point how a lot achieve or loss can be realized from a trade. The most heavily traded foreign money pairs on the earth contain the U.S. dollar fibonacci calculator (USD). When USD is listed second in a pair, pip values are fastened and don’t change if you have an account funded with U.S. dollars. In foreign trade (forex) trading, pip value is usually a complicated matter.

How many lots can you trade in forex?

You want to make 1 million dollars in Forex profits. All you need to do is increase your Forex trading account by 200% and you will have 1 million dollars. If you were to make an average of 10% profit a month, it will take 1.7 years for you to make 1 million dollars.

0 Comments

Leave your comment here