More on place to open ira

Gold in a Self Directed IRA

The number of years in business is relevant as well when assessing a gold IRA company, as the veterans in the industry have reached that status by providing top notch services throughout their journey. The business provides personalized consulting and educational resources to help clients accomplish their investing goals. The company offers a wide range of options, including self directed IRAs and 401k rollovers. The best type of gold to buy for an IRA is generally gold that is 99. You can expect to pay $250 per year for storage $150 for the segregated storage and another $100 for custodial maintenance. When withdrawing from your precious metals IRA, you have two options. I’ve never seen such a large company with such a huge impact on giving back to their community. We must receive all complete and correct documentation at least 2 business days prior to the day you wish funds to be sent. No hard sell policy. ☑️ Exclusively Recommended by Bill O’Reilly, Rick Harrison, Mayor Giuliani and Others. Experience the Power of GoldCo: Invest in Your Future Now.

Social

You can include a combination of gold, silver, platinum, and palladium precious metals. Privacy Policy Terms of Use Do Not Sell My Info Sitemap. Your options for investing in bullion, numismatic, and semi numismatic metals better than competitors. BBB: A+ From 44 Reviews. Wide range of product offerings. This is quite important as the circulation of internationally minted products was not allowed in the 1990s. Additionally, the best gold IRA companies should provide investors with a secure online platform to manage their investments and access their account information. The goal here is to give clients the information they need in a format that is easy to digest to make the best possible investment decision. One other quality that all IRAs have become known for is the cost. Their knowledgeable staff is available to assist customers with any questions they may have.

Ready to start investing in your future?

Gold has historically held its value over time, even during high inflation or economic uncertainty. Self directed IRAs can be traditional IRA traditional SDIRA or Roth IRA Roth SDIRA and the same rules regarding contributions, income limits, and distributions apply to them as apply to mainstream IRAs. Q 4 How do I open a gold IRA account. This fee includes insurance, storage, and access to an online account. If the value continues to shrink, paper heavy assets could be worth a lot less in retirement. If you are not sure of what you should invest in, the experts on Goldco’s team would be happy to assist you and offer any tips and advice to help you in your decisions. Best for free Gold report IRA guide. To find the right company for you, this includes reading reviews and comparing them. It is one of the best gold IRA companies due to its commitment to providing customers with exceptional service and expertise. Their expertise in precious metals investments, commitment to customer satisfaction, and transparent fee structure make them stand out from the competition.

Software and Business

Check out some of the reasons for investing in gold in the following section. However, the company does work with industry leaders in this area, making the lack of diversity a non issue for most normal gold investors. At this point, the paperwork is completed by both parties, and the company, acting as the trustee, handles the remaining steps. Straight to Your Inbox. Noble Gold Group also offers hassle free, no brainer Royal Survival Packs, which pair the best types of precious metals together for easy purchasing to protect your investments. While the value of the dollar has decreased over time, gold prices have grown more than the dollar over certain periods of time. Also, their low annual fees, highest buy back guarantee, A+ rating by the Better Business Bureau and AAA rating by the Business Consumer Alliance makes them the best and safest option to open up your gold IRA account. Augusta works with trustworthy custodians such as Equity Trust, Gold Star Trust Company, and Kingdom Trust who can administer your new IRA. Experience the Benefits of Investing with GoldCo Start Today. Premier advice, solutions, and service for select individuals and institutions. When you purchase precious metals through a gold IRA, you must store them outside your home with a custodian at a secure depository.

What Is a Gold IRA Rollover?

“Protectors” of industry, warnings of some company’s questionable tactics. The benefits of investing in a Gold IRA are security, stability, tax free growth, diversification, and hedging against volatility. The company has an A+ rating with the Better Business Bureau and 5 out of 5 stars on Trustpilot, as of September 20, 2022. If you cash out your self directed IRA before turning 70, you’ll have to pay additional taxes unless you’re withdrawing the money for a specific reason. Invest in Gold with Confidence: Try GoldBroker Now. As an Amazon Associate Retirement Living earns from qualifying purchases. Shapiro even helped bring to the fore the option to rollover an IRA or eligible 401k into an IRA backed by physical gold and silver. More and more Americans are taking advantage of bargain gold prices by adding the yellow metal to their retirement portfolios. Wealth isn’t just for the wealthy. >>>>Click here for Free Gold IRA Kit<<<<. Per IRS requirements, Goldco will be responsible for storing your precious metals through an insured depository. Additionally, the company is an experienced and knowledgeable gold IRA custodian, making them a great choice for those looking to invest in gold.

Day In Pics: May 22, 2023

Unlike some competitor gold IRA firms, Birch lacks a blog and diversified investing articles. Gold, silver, platinum and palladium available. Securities and Exchange Commission. For example, they’ll guide and educate you about gold IRAs so that you know exactly what you’re doing when you invest with them. Their services are extensive, but remember that the custodian is primarily responsible for investing assets on your behalf. It is home to a skilled staff of IRA experts who present you with investment options in the most comprehensive and organized way possible. Overall, a gold IRA custodian or broker can provide valuable assistance in navigating the complexities of gold IRA investments. With Noble Gold, customers can rest assured that their gold IRA investments are in good hands.

Gold Alliance: Summary Best Gold IRA Companies

If you’re new to investing in precious metals, be sure to claim your free copy of our company’s 2023 Smart Moves Guide and 7 Blunders Report online or call us toll free at 800 300 0715. While there are some risks associated with Gold IRAs, potential investors should weigh these against the potential benefits before making a decision. These companies are all highly recommended and should ensure your money is handled correctly. These required distributions must begin by April 1st of the following year after turning 70 1/2 72 and they can come directly out of your account or via cash payments with no additional tax imposed beyond what is already owed. It’s good to know that a gold IRA rollover is easily done by the best gold IRA company. Besides, you will be invited to a one to one web conference in order to educate you before you can buy anything. On top of that, there are no major counter party risks. Additionally, the company is an experienced and knowledgeable gold IRA custodian, making them a great choice for those looking to invest in gold. Your investment journey with gold begins with the creation of a self directed IRA SDIRA. Similarly, buying gold may not be the best idea if the dollar or other currencies are going down. If you really want to keep some gold at home, there are a couple of options.

Overnight, U D police say that child is missing

Additionally, the IRS only allows specific gold coins such as the American Gold Eagle and Canadian Maple Leaf. Browse the tax advantaged accounts and find one that matches your savings goals – from retirement to education to health care savings. What are the tax benefits of purchasing Gold through an IRA. Goldco has received an A+ rating from the Better Business Bureau and a Triple A rating from Business Consumer Alliance. It’s best to work with a reputable gold investment company that can help you manage your investment without taking physical possession of the gold. Increasing Gold Value. Nora Carol Photography / Getty Images. Free storage of physical gold and silver.

American Hartford Gold Group: Pros Gold and Silver IRA

Augusta Precious Metals is one of the best gold IRA custodians in the industry. On top of that, each company has their own markup fees for every precious metal transaction. Under the scheme, the issues are made open for subscription in tranches by RBI in consultation with GOI. The process is relatively simple and involves transferring the funds from an existing IRA or 401k account into a new IRA account that is specifically designed to hold gold and other precious metal investments. The IRS defines many popular coins as collectibles, and therefore, not permissible in IRAs. This review looked at customer service, fees, investment options, storage options, and customer reviews. To maximize the potential benefits of investing in a Gold IRA, it’s important to diversify your portfolio. The modest $200 annual fee waived the first year is a bit higher than other companies but gives you the ability to see your own assets at any time. Invest in Your Future with American Hartford Gold Group’s Reliable Services. With the help of the best gold IRA companies, you can easily diversify your retirement portfolio and protect your savings. †Advertiser Disclosure: Many of the offers that appear on this site are from companies from which CreditDonkey receives compensation. We have several account types to suit your annual spend.

How we rated Augusta

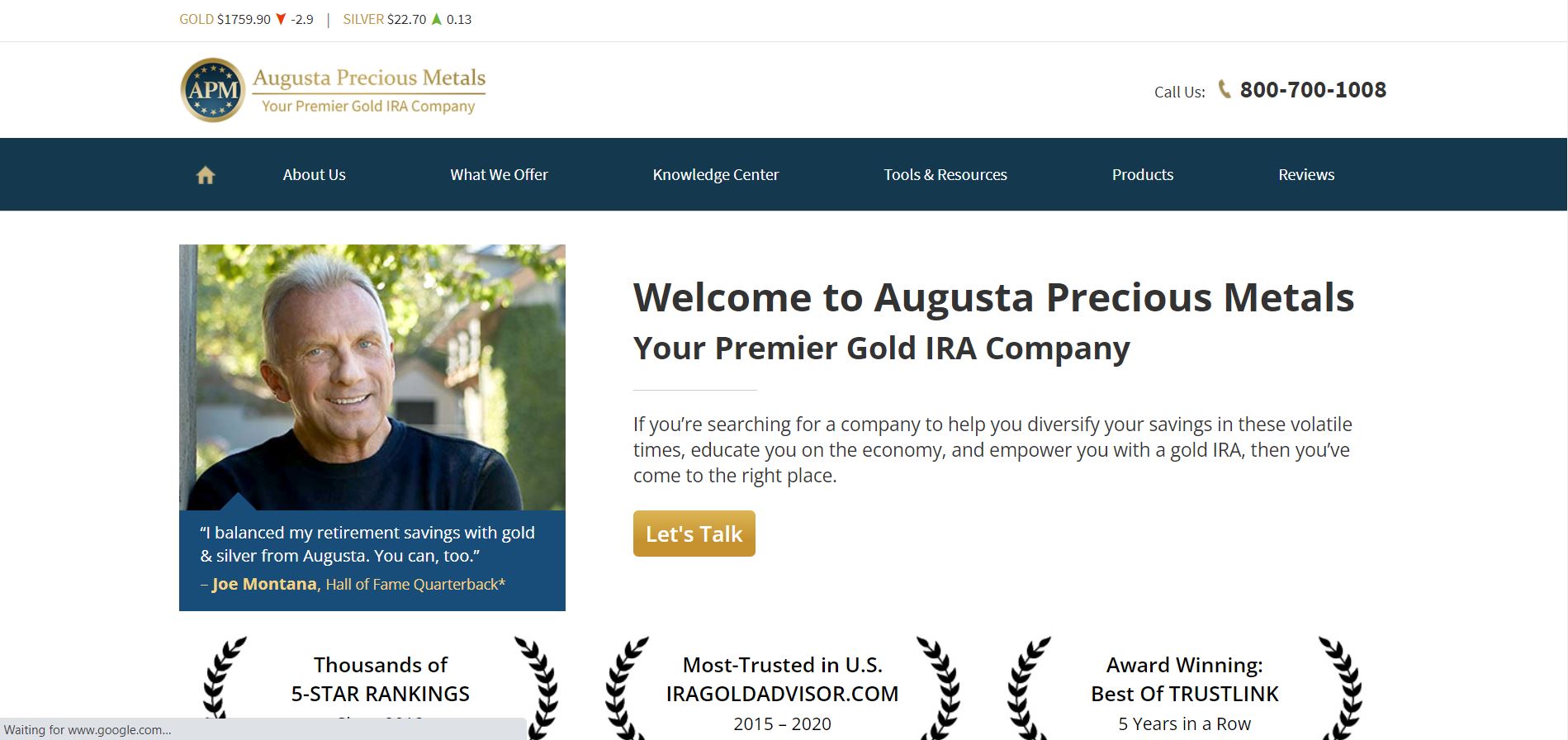

100s of customer reviews, and endorsements by conservative talk show hosts and hall of fame quarterback Joe Montana. The best Gold IRA companies have been in business for many years and have a proven track record of success. When considering a gold IRA rollover, it is important to research the best gold IRA companies to ensure that the process is handled properly and securely. Compare different companies to find the most competitive pricing. This involves selling it back to the gold IRA company at an inflated price. The company is renowned for offering a “white glove service” from account setup through the most recent transaction. Q: Are there any tax advantages. Experience the Benefits of Joining the Patriot Gold Club Today. They provide a wide variety of gold and silver coins, bars and rounds, as well as a range of other precious metals. This process is usually necessary to fund new gold IRA accounts. The company offers a variety of services, including gold IRA rollovers, gold IRA transfers, and gold IRA storage. All of the best gold IRA companies will have advisors to help you through the process.

What Birch Offers:

Given that there are hundreds of gold IRA companies, it’s a good idea to stop and look at what makes them unique and different from one another. For instance, if you’re buying physical gold coins then you may have to pay a premium above spot price plus shipping charges and any applicable taxes. Editorial Note: Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer. When it comes to IRA contributions, disbursements and taxes, gold IRAs follow the same rules and procedures as other IRAs. The traditional way of investing in gold is coins and bars. Augusta Precious Metals, based in Los Angeles, brands itself as “Your Premiere Gold IRA Company,” and I couldn’t agree more.

Fees

Refer a friend program. Your unique needs and goals come before dollars in employee paychecks. Altogether, we highly recommend Goldco as a reliable gold IRA company. Give them a call now at 866 243 8055 and request their free gold IRA investment guide. Source: Augusta Precious Metals BBB. 4 out of 5 stars on Consumer Affairs for its assistance and highly professional customer service. Offers free shipping and insurance for all orders. With an A+ rating at the Better Business Bureau, 5 stars on TrustLink, and a strong reputation on Trustpilot, Augusta Precious Metals is considered one of the most reliable gold IRA providers in the industry. They offer competitive pricing, no setup fees, and are accredited with the Better Business Bureau. That’s why the Gold IRA rollover has become very popular. You can purchase these coins by first signing an agreement on the Goldco website, and then funding your account with a bank wire or mail in check.

What the Wealthy are Saying About Gold Investing

The Journal of Accountancy is now completely digital. Read, browse each firm’s IRA approved precious metals selection, and ask questions before you choose how to fund your gold IRA. Access to rare and collectable coins. Experience the Security and Convenience of Investing in Noble Gold. It has also earned top marks from the Business Consumer Alliance. Lear Capital has been helping investors since 1997, and they strive to not only earn your business but to maintain it with great service. While gold IRAs offer many benefits, we don’t recommend going into one blindly. Some investment plan sponsors don’t have an age limit, so contact them to confirm your options. They provide a comprehensive gold IRA rollover guide to help clients understand the process and make informed decisions.

Take Delivery of Your Kilo Bar

This could be anywhere from three hundred dollars up to several thousand depending on what company you use. For example, it costs a lot more to buy a 1,000 square foot house today than it did 50 years ago. The depository holds your precious metals until the time you want to sell or take physical possession of them. This can help you to meet your retirement goals and provide you with financial freedom. These gold bars are often a more cost effective option than gold coins and are a great choice for those looking to invest in a large amount of gold. However, this does not influence our evaluations.

Augusta Precious Metals Receives ‘1 Best Gold Company’ Honor From IRAGoldAdvisor com

In addition to transparency, Augusta Precious Metals provides a money back guarantee if you are dissatisfied with their work. Does the “review” website primarily highlight one gold IRA company. In addition, you have access to a highly trained service team including. Next, take a look at customer reviews online and on social media sites like Yelp. They were narrowly edged out in this review by Augusta due to Augusta’s strong focus on customer education and impeccable customer reviews online. The company has become a popular choice when it comes to precious metal investments because they’re known to go above and beyond when it comes to great customer service.

Keep in mind

Or greater and it ensures that the bars are kept separate from the other metals in the depository’s vault. Their dedication to providing the best gold IRA services and their competitive pricing make them a top choice for those looking to invest in gold. Instead, the IRS requires gold IRA investors to keep their gold with an IRS approved custodian, such as a bank, credit union, or other financial institution. The Birch Gold IRA, like all of those on our best gold IRA list, has an A+ BBB ranking and top marks on TrustPilot and ConsumerAffairs review websites. As mentioned below with Goldco, there are others on this list that will work with new accounts as low as $10,000. Plus, iTrustCapital doesn’t charge storage fees. However, since all the gold IRA providers on our list offer comparable services, you can confidently choose any of them to assist with your gold IRA investment if you’re ready to convert your IRA to gold IRA. Moreover, Birch Gold Group provides a variety of educational resources, making it an ideal choice for first time gold investors.

Get The FREE 2023 Gold IRA Kit from Goldco

Click here to learn more about Birch Gold Group. Foreign companies and investment opportunities may not provide the same safeguards as U. He specializes in growth marketing, content marketing, online courses, and remote work. Investing in gold offers a high return and increases in value over time, especially during times of uncertainty or recessions. They are two completely different types of investments. Q: How do I choose a gold IRA custodian. Birch Gold Group built its name on customer service, as evidenced by online testimonials. TrustPilot: 5 Stars From 1,124 Reviews. Typically, these companies charge three types of gold IRA fees. It’s also vital that you find out what actual customers have said. You’ll also have a $100 annual custodian fee with an annual storage fee of $100. Although palladium is a rare and valuable metal, it is not as heavily focused on by investors as gold and silver. According to recent research, the top gold and silver IRA companies offer their clients competitive pricing, excellent customer support, and reliable information. This is a retirement investment option with tax benefits allowed by the IRS.

ReadLocal

Through our practical knowledge, we discussed everything you should know before investing in precious metals. The company provides clients with the resources they require to come up with a diverse investment portfolio. If you time your investments right, your IRA can store American Gold Eagles and Gold Buffalos, Canadian Maple Leaves, and various bars. Additionally, make sure that the company offers a variety of services, such as gold storage, asset management, and tax advice. Choose how you would like to fund your new precious metals IRA account. This gives the process a human touch that some online portals just can’t match.

Subscriptions

The company chose Texas as its storage location for a few reasons. “However, because the dollar is so strong, as it’s also a popular investment during periods of volatility, gold hasn’t seen as much of a bounce as expected yet. And American Hartford Gold Group free coin offerings for eligible clients. A Gold IRA is a form of IRS approved precious metal retirement account that operates in the exact same manner as any other typical individual retirement account. You can open a gold or silver IRA in three easy steps. It functions the same as a regular IRA, only instead of holding paper assets, it holds physical bullion coins or bars. It is worth noting that Goldco offers fair market rates for the buybacks of silver and gold. Patriot Gold Group is a top rated gold IRA dealer that provides a safe, educated, and straightforward method for investing in precious metals. The decision to purchase or sell precious metals, and which precious metals to purchase or sell, are the customer’s decisions alone, and purchases and sales should be made subject to the customer’s own research, prudence and judgment.

0 Comments

Leave your comment here