Economic calendar

Economic calendar

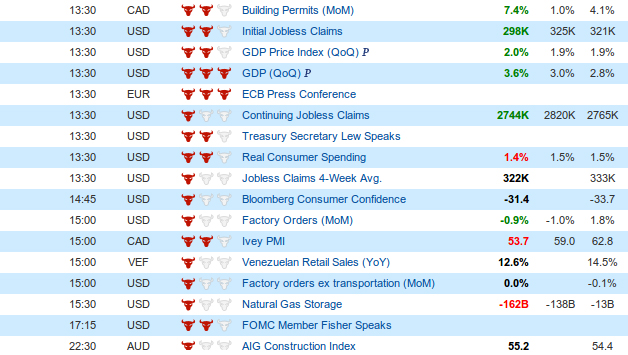

You can also dig deeper into global financial trends and events with our latest news and analysis articles. Our forex economic calendar is fully customizable, helping you keep track of the exact data you’re interested in. Select specific time zones and currencies of interest and apply filters to refine results and fit your strategy.

Changes in Retail Sales are widely followed as an indicator of consumer spending. Generally speaking, a high reading is seen as positive, or bullish for the Norwegian krone, while a low reading is seen as negative or bearish. The CBI Distributive Trades Survey released by the Confederation of British Industry is an indicator of short-term trends in the UK retail and wholesale distribution sector.

How to use the FXStreet economic events calendar

The Retail Sales released by INEGI measures the total receipts of retail stores. Changes in retail sales are widely followed as an indicator of consumer spending. Generally speaking, a high reading is seen as positive or bullish for the Mexican peso, while a low reading is seen as negative or bearish. The GDP Price Index released by the Bureau of Economic Analysis, Department of Commerce gauges the change in the prices of goods and services. Changes in the GDP price index are followed as an indicator of inflationary pressure that may anticipate interest rates to rise.

It is considered as an important indicator of inflation, as monetary expansion adds pressure to the exchange rate. Usually an acceleration of the M3 money is considered as positive, or bullish for the EUR, whereas a decline. The Coincident Index released by the Cabinet Office is a single summary statistic that tracks the current state of the Japanese economy.

The Economic Calendar may also be subject to change without any previous notice. Furthermore, the big market reaction can occur even despite prior data of scheduled economic events. For example, the ECB decides on the invariability of interest rates, and, as a result, the euro will rise significantly. To be sure of your Forex trading strategy, you should pay attention to PaxForex fundamental and technical analysis, which is published on a daily basis. Trading Economics Calendar requires prior review and training, which will determine which stories are important to a certain situation.

The Consumer Confidence released by Statistics Portugal is a leading index that measures the level of consumer confidence in economic activity. The Retail Sales released by the SCB – Statistics Sweden is a measure of changes in https://en.forexpamm.info/ sales of the Swedish retail sector. The changes are widely followed as an indicator of consumer spending. A high reading is seen as positive (or bullish) for the Krona, while a low reading is seen as negative (or Bearish).

The Trade Balance released by the National Institute of Statistics is a balance between exports and imports of total goods and services. If a steady demand in exchange for Italian exports is seen, that would turn into a positive growth in the trade balance, and that should be positive (or bullish) for the common currency. The Gross Wages released by the Hungarian Central Statistical Office, portraits the percentage variation of wages for that period over the same of the previous year,. Wages are considered monthly earnings on average for the working population within the economy. Generally, a high reading is considered positive for the economy as it might stimulate consumption.

Its purpose is to empower Forex, commodity, cryptocurrency, and indices traders and investors with the news and actionable analysis at the right time. First and foremost, the news calendar should never be used as a tool to help you enter the market. In other words, attempting to trade a news event for the volatility it causes is a surefire way to blow up a trading account. Everything from how to configure the Forex Factory calendar to how to use it when trading price action.

- CPI is the most significant way to measure changes in purchasing trends.

- A high reading is seen as bullish for the JPY, whereas a low reading is seen as bearish.

- Because market reactions to global economic events are very quick, you will find it useful to know the time of such upcoming events and adapt your trading strategies accordingly.

- It’s the most complete, accurate and timely economic calendar of the Forex market.

- Normally, a decrease in the figure is seen as positive (or bullish) for the Polish Zloty, while an increase is seen as negative (or bearish).

- The Coincident Index released by the Cabinet Office is a single summary statistic that tracks the current state of the Japanese economy.

FXCM Markets Limited (“FXCM Markets”) is incorporated in Bermuda as an operating subsidiary within the FXCM group of companies (collectively, the “FXCM Group” or “FXCM”). FXCM Markets is not required to hold any financial services license or authorization in Bermuda to offer its products and services. The industry consensus is the market’s “best guess” regarding a pending economic event.

With the regular use of the XM economic calendar, you can follow the release schedule of numerous economic indicators and get ready for significant market movements. Economic indicators help you consider trades in the context of economic events and understand price actions during these events. By following indicators for GDP, for instance, or inflation and employment strength, you can anticipate market volatility and gain potential trading opportunities in good time.

In this post, there’s a list of other websites providing economic forex calendars that many other trader use as well. Financial market trading carries a high degree of risk, and losses can exceed deposits.

Central Banks

As soon as event data is released, the DailyFX calendar automatically updates to provide traders with instantaneous information that they can use to formulate their trading decisions. Depicted as yellow/orange/red bars, the impact is a basic indicator of the potential move a data release might trigger on currencies. Shall a bar be red and long, market observers expect this data to have great probability to move the Forex market.

This will help you not only follow a wide range of major economic events that continuously move the market but also make the right investment decisions. Because market reactions to global economic events are very quick, you will find it useful to know the time of such upcoming events and adapt your trading strategies accordingly. Economic data indicators and mood sentiment change often so stay informed by checking our forex economic calendar daily. FX currency pair movements happen quickly so get to know the daily and foreign exchange weekly economic calendar to anticipate market trends.

The Business Confidence released by Statistics Portugal is a survey of the current business condition in Portugal. The Trade Balance released by the SCB – Statistics Sweden is a balance between exports and imports of total goods and services. A positive value shows trade surplus, while https://en.forexpamm.info/main-qualities-of-forex-brokers/ a negative value shows trade deficit. It is an event that generates some volatility for the Swedish Krona. If a steady demand in exchange for Swedish exports is seen, that would turn into a positive growth in the trade balance, and that should be positive (or bullish) for the Krona.

Quickly analyze previous data sets against market consensus, and check volatility for potential trade ideas. Advanced forex news calendar automatically updated in real-time as soon as current economic events get released. Customize it by selecitng the time zone and filtering economic events by market impact, currencies, and their type. See economic news sources, descriptions, frequency, and historical list of events with the data.

The basic principle is that positive forecast and events lead to an increase in currency and negative to its fall. At constant exchange rates affect both short-term economic developments and market expectations. It is known in advance about the release of the important fundamental news and it is possible to determine what changes will occur in the Forex market. The Financial news calendar is a handy tool for every Forex trader that allows keeping abreast of important developments in the economy of practically all countries.

0 Comments

Leave your comment here